Do your clients depend on their income? It may be an obvious question, considering that working and earning a paycheck is how most people fund their financial needs and wants (i.e., homes, cars, groceries). That said, too many people overlook purchasing individual disability income (DI) insurance and misunderstand its role within a financial plan.

An income allows people to provide for themselves and their families, enabling them to live for today and invest in their future. If an unexpected illness or injury interrupts the ability to work, pausing or stopping their income stream, finding ways to maintain a lifestyle may quickly become complicated. Undoubtedly, finances become an added burden when dealing with a medical event.

Disability income insurance is paycheck protection. It can eliminate the worry and answer the what-ifs. In the event of a qualifying disability, this coverage guarantees at least a partial income, potentially preventing the need to deplete savings or incur debt. Providing for a family is stressful enough when everyone is healthy, but without a plan, even the best intentions can lead to unmanageable circumstances. Knowing this, why isn’t income protection at the top of every to-do list? Protecting one’s income should be as automatic as insuring a home or car, particularly for someone reliant on their paycheck.

Where is the Disconnect?

Helping clients understand the need for disability insurance starts with clearing the barriers between perception and reality. Let’s explore a few possibilites on why your client might not be exploring income protection.

The Odds Are Low | Many assume the chances of becoming disabled and being unable to work are unlikely, thinking disability insurance is only necessary in case of an accident or severe illness. When in fact, according to the Social Security Administration, one in four of today’s 20-year-olds will experience a disability that prevents them from working for at least a year before they reach retirement age. The notion of “It won’t happen to me” is possibly why disability insurance is one of the most misunderstood and overlooked insurance solutions.

I Won’t Get Hurt | It is important to help clients understand the wide range of disabilities that can cause a need for disability insurance. One misconception is that a qualifying disability is usually an injury from a sudden accident. The Council for Disability Awareness highlights the reality that chronic conditions like musculoskeletal disorders, cancer, and mental health issues like anxiety and depression are among the leading causes of long-term disability claims. As the prevalence of chronic conditions increases in today’s society, so does the need for disability insurance.

I Have it Through Work | According to LIMRA’s Consumer Sentiment survey, over 70% of workers depend on their employee benefits plan to fulfill their disability insurance requirements to some extent. However, group disability insurance provided by your employer may not fully meet your needs, often having limitations such as capped benefits or restrictions on coverage. By adding personal disability insurance, you can have broader coverage tailored to your financial situation and needs and potentially higher benefits to replace your income.

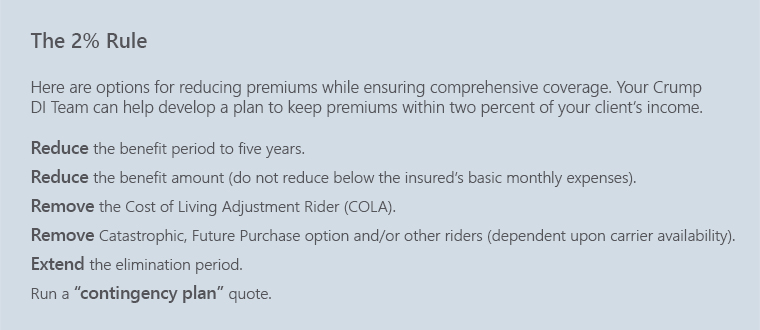

It Sounds Expensive | Most people will assume disability insurance is out of their budget and, therefore, decide not to pursue it. The Council for Disability Awareness conducted a survey showing that 65% of working adults believe disability insurance is too expensive. Generally, illustrations should show annual premiums between one and two percent of the insured’s annual income to ensure the policy’s affordability. Some DI coverage is always better than none, and there are ways to lower premiums without sacrificing quality coverage, such as reducing the benefit period. Most carriers observe that the average claim lasts between two-and-a-half to four years. While some policies extend benefits until ages 65, 67, or 70, shortening this period can be an effective cost-saving strategy. Opting for a five-year or 10-year benefit period still covers the typical duration of a DI claim while allowing for flexibility if the claim extends longer.

“It took many years filled with numerous trials and errors with different medications and dosages to get to the place where I am today, functioning as well as expected. Surprisingly enough, I worked through all of this. How could I not? As a single mom, I cannot cover living expenses for myself and my children with only 50% of my paycheck. If I had purchased DI, I could have minimized the financial stresses that undoubtedly exacerbated my symptoms, consequently increasing my pain throughout those trying years. Since then, I have developed a few other conditions on top of rheumatoid arthritis, so I am now completely uninsurable.”

Talking With Your Client

Disability insurance isn’t just a product to sell; it’s a necessity to be bought. As a financial professional, you want to ensure your clients understand the potential income gaps and risks associated with a disabling event. Crump is committed to supporting you in starting these conversations and providing guidance. Explore our resources below for practical examples of approaching these discussions and empowering your clients to make informed decisions about their income protection.

“What is your most important asset?”

Many people may respond that their home, car, jewelry, and other physical possessions are their most important assets. While these are all important, the ability to earn a living and receive a paycheck is their most valuable asset. It is what pays for people’s physical assets, family expenses, and many of their plans for the future.

“How important is your income to your everyday life?”

Most people understand the value of their paycheck when presented in the context of the things it can buy. However, what happens if that paycheck stops due to an illness or injury? Another question to ask is, “If your next paycheck was your last paycheck for the next four years, what’s your plan?”

“What are you doing to protect your income?”

Many people might say that they have disability coverage through their employer or that they could use workers’ compensation coverage if they cannot perform their jobs. What they might not know is that group DI may offer far less than their actual income and much less than would allow them to live comfortably. In addition, workers’ compensation only covers their income if injured while performing their job.

“Do you have your “MUG” covered?”

Many people hesitate to purchase DI because they believe it is too expensive. However, having some coverage in place if a disabling event causes them to be unable to work could help cover basic living expenses and pay bills. Not having to worry about paying for the mortgage or housing, utilities, or groceries (MUG) may bring peace of mind when trying to recover from a disabling event—so could being able to meet their families’ basic needs.

“What if you could protect your income for less than the cost of cable or internet?”

Many people consider affordability an important consideration and a common objection to purchasing DI. To help alleviate clients’ concerns that DI is too expensive for their budget, provide options that show coverage can be affordable and customized to fit their unique needs. Refer to the 2% Rule mentioned above.

Bottom Line

The recurring theme here is clear: there’s a crucial need for understanding disabilities and disability insurance. Despite its inherent value, there is still a disconnect on the amount of clients seeking guidance or purchasing this essential product to protect their livelihood. As a financial professional, knowing there are common misconceptions surrounding disability insurance, such as the odds of needing it, what types of disabiling events are common and qualify, how effective employer coverage is, and how much it will really costs, it is critical to bring up this topic with your clients. Use our suggested conversation starters to approach your clients and start to unpack some of these areas of concerns or objections. Crump wants to help you deepen your knowledge of disability insurance and make the connection for your clients. Contact the Crump Disability Solution Center today for assistance in creating DI plans that meet your clients’ needs and fit their budgets.

Contributors

Kenny Russell is the Director of the Crump Disability Solution Center. He has been with Crump for over 20 years and is passionate about raising awareness about the income protection gap. Kenny leads a team of wholesalers; together, they educate countless financial professionals and clients on the importance of disability insurance and flexible product design to meet all client needs.

End Notes

12022 Insurance Barometer Study, Life Happens

https://lifehappens.org/research/owning-life-insurance-provides-a-clear-path-to-financial-security/

2Disability Impacts All of US, Council for Disability Awareness

https://www.cdc.gov/ncbddd/disabilityandhealth/infographic-disability-impacts-all.html

3Only 20% of Consumers Own Disability Insurance Despite Almost Half Saying They Need it, LIMRA

https://www.limra.com/en/newsroom/industry-trends/2019/disability-insurance-awareness-month--only-20-of-consumers-own-disability-insurance-despite-almost-half-saying-they-need-it/