The rise in popularity of cash indemnity long term care insurance (LTCi) policies reflects a broader trend toward personalized and flexible financial solutions. Industry reports indicate that sales of these policies have surged, surpassing those of traditional reimbursement LTCi policies, which require individuals to submit bills and receipts for covered expenses, a complex process that can leave the insured with uncovered expenses, complicating their care management.

Understanding LTC Services

LTCi is designed to help pay expenses of LTC services not covered by health insurance, Medicare, or Medicare Supplement Insurance. Services include personal and custodial care in various settings such as the home, adult day care facilities, assisted living, nursing facilities, or hospice. These services are often costly, and individuals may face substantial out-of-pocket expenses. LTCi provides a fixed daily or monthly cash benefit for care services once a policyholder qualifies, helping to prevent the depletion of savings and retirement funds.

Qualifying Events

For a LTCi benefit period to begin, a policyholder typically must be certified by a licensed health care practitioner as unable to perform at least two activities of daily living (ADLs), such as bathing, dressing, eating, toileting, transferring, and continence, without substantial assistance or having a severe cognitive impairment that requires supervision. These qualifying events trigger the start of the benefit period, which may vary depending on the policy terms and options selected. Some examples of illnesses or conditions that usually qualify for LTC services are:

• Alzheimer’s disease or other forms of dementia

• Stroke or brain injury

• Parkinson’s disease or multiple sclerosis

• Spinal cord injury or paralysis

• Cancer or terminal illness

• Arthritis or osteoporosis

• Diabetes or heart disease

• Frailty or old age

Informal Caregivers

A common misconception is that LTC primarily takes place in nursing homes. However, most care occurs at home and is provided by professional healthcare aides, friends, or family members. Relying on unpaid help from loved ones for an extended period can be taxing in many ways and take a toll on them. Having the funds to pay informal caregivers could alleviate some of the burden during difficult times. Once extended care starts, it is not always continuously needed. Around 33% of those receiving extended care recover and do not need the same level of service for their lifetime.²

Reimbursement vs. Cash Indemnity Policies

Clients today find even more value in their LTCi coverage options with the ability to choose cash indemnity policies. This model, now competitively priced, offers significant advantages over reimbursement policies. Like reimbursement LTCi, the benefits received are generally tax-free, and premiums may be tax-deductible for individuals who itemize deductions.

Reimbursement Policies

- The policyholder pays for care directly and submits bills and receipts to the insurance company for reimbursement.

- This process can be burdensome and may delay care without financial liquidity to cover upfront costs.

- Approved providers and types of care are often limited.

Cash Indemnity Policies

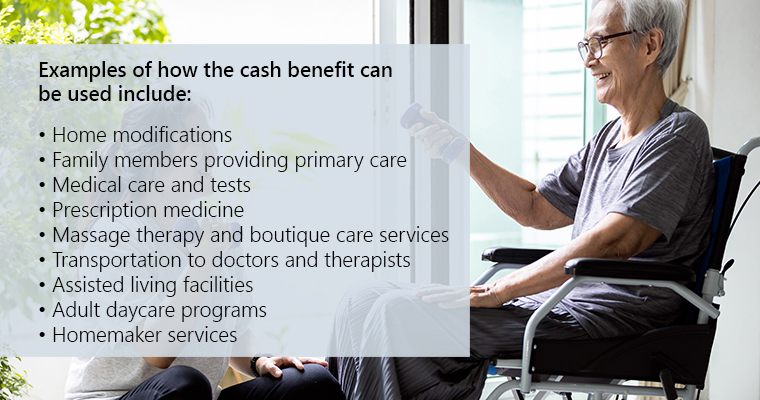

- The insurance company provides a predetermined cash benefit, regardless of expenses incurred.

- The benefit can be used flexibly without upfront out-of-pocket costs.

- The policyholder can use the cash for various care services, including informal care from family

members or other expenses related to their medical condition.

Complementing Disability Insurance

Another benefit of cash indemnity LTCi is the ability to complement an individual’s disability income insurance. While disability insurance focuses on replacing lost income due to a work-preventing disability, LTCi addresses the need for assistance with daily activities or cognitive supervision, which may not result in income loss but can incur significant expenses. While disability insurance has financial underwriting and may include exclusions, cash indemnity LTC contracts typically do not have the same financial underwriting requirements and exclusions. This means a chronic illness LTC claim could be covered even if excluded by a disability insurance policy.

Bottom Line

The key to extended care planning is to start. Any coverage is better than no coverage. With approximately 70% of Americans over 65 likely needing some form of LTC services during their lives,4 it is something to consider for you and your family who may be responsible for your care. Cash indemnity LTCi contracts offer a flexible option for covering LTC services and may provide more options to have in-home care with an informal caregiver. Talking with your financial professional, who can bring in an insurance professional, will give you the opportunity to find the appropriate LTCi benefit that will support the type of care you desire with a benefit model that fits your needs.