The experience of owning a business brings significant rewards and constant challenges, with important decisions shaping its path each day. Planning for the transition of a business, whether by choice or circumstance, is not always a top priority for many business owners. But the right strategy can make all the difference. While there are many ways to structure a plan for business continuity, the most suitable choice often comes down to very specific and unique facts associated with both the business itself and the people or entities that own it.

There are two basic types of business continuation plans for personally held businesses, with variations of each:

- Cross-purchase plans: the remaining owners buy the business interests of the departing owner.

- Entity purchase plans: the business buys back the interests of the departing owner.

While each type has its own benefits, there are also drawbacks:

- A cross-purchase plan is simple and easy to understand. However, multiple policies are required if the buy-outs are funded with life insurance. For example, if a business has four owners, each would need to own three policies on the lives of the other owners, for a total of 12 policies.

- An entity purchase plan only requires the business to own one policy for each owner, but the life insurance owned by the business can increase the value of the business for estate tax purposes.

Fortunately, there are other alternative structures that can maximize the pros while minimizing the cons. Enter the Insurance Limited Liability Company (LLC).

Insurance LLCs

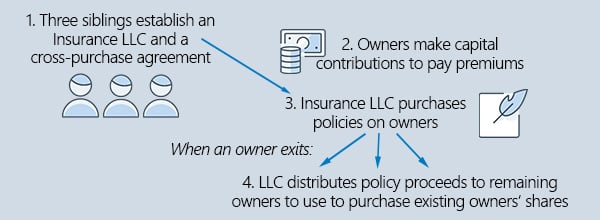

An Insurance LLC operates as a hybrid of the two types of buy-sell agreements. The parties agree to purchase each other’s interests once a triggering event occurs. They also establish a separate business to administer the buy-out — that business is the LLC and it will be taxed as a partnership and managed by a third party. The LLC will own a life insurance policy on each owner, and the owners will typically make capital contributions to the LLC to cover the premium costs.

If an owner dies, the LLC will redeem that owner’s interest in the LLC, and will either buy the interests of the primary business and distribute them to the surviving owners, or will distribute the death benefit to the surviving owners to purchase the interests themselves. Now, the survivors have the business and have likely received a basis increase in the new interests, and the deceased owner’s family has the value for the interests that likely received a stepped-up basis

at death.

If an owner leaves during their lifetime, the policy on that owner’s life can be used a part of the purchase price for the interests. If the value of the policy is not enough to cover the full purchase price, the LLC can use cash from some of the other policies, or the other owners can buy-out the remainder with an installment note. The departing owner can then re-purpose the insurance for income in retirement or a death benefit needed for planning.

Success Story

An Ultra High-Net-Worth Family Needed a Business Succession Plan as Unique as its Structure — and the Solution Became One of the Largest Life Insurance Cases in the Industry.

Faced with the complex task of preserving a $600 million family-owned enterprise, a financial professional partnered with his Crump representative to guide a multi-generational family through their estate and business succession planning. With each family member — parents and three children—holding equal ownership stakes, the planning needed to be strategic and collaborative.

Let's take a look at the case:

Client Profile

- Parents + three children | each owning 25% of a family business

- $600 million net worth

- Goal to establish a business succession plan with a mechanism for buying out each other‘s interests while remaining flexible

Solution

The Insurance LLC will hold the policies and buy out an exiting owner. If the business is sold, the policies can be distributed to each owner and used for other purposes.

Advantages and Considerations at a Glance

While an LLC can provide many advantages, there can be some disadvantages depending on the situation.

Benefits:

- Easy to understand

- Minimizes the number of insurance policies needed

- Basis increase for purchasing owners

- Possible creditor protection

- Flexibility

- Easy to add future new owners

Drawbacks:

- Complex drafting of agreement

- Costs to set-up and manage another business entity

- Compliance with business tax laws and regulations

- Should be managed by a third-party manager to avoid inclusion of the insurance in the owners’ estates

![]()

Estate tax planning with LLCs can be complicated for all tax matters. Therefore, owners should work with attorneys and accountants familiar with tax planning for entities taxed as partnerships.

How it Works

Let's look at an Insurance LLC in action with this example story. Max, Audrey, Jamie, and Bernard own a manufacturing firm worth $40 million. They like the simplicity of an entity purchase plan, but are concerned with the increase in the value of their shares if the company owns life insurance on their lives. They also don’t like the idea of having to purchase 12 policies to fund a buy-out as would be required under a cross-purchase plan.” Could an Insurance LLC be the solution?

If the four owners created a new Insurance LLC, it could buy one $10 million policy per owner to fund a buy-out. Instead of 12 policies, they only need four. Each owner could contribute to the LLC the premium payment for the policy on that owner’s life. When one of the owners exits the business, the LLC will use the policies to fund a buy-out from both the LLC and the primary business. Once the buy-out is complete, the three remaining owners will own both the LLC and the primary company, and business can continue as usual.

Bottom Line

Business continuation planning is a dynamic process with many possible forms. While an Insurance LLC won’t be the right fit for every business, it offers an alternative to those owners who want the tax benefits of a cross-purchase while minimizing the numbers of policies needed for funding. Ultimately, an Insurance LLC is an alternative that keeps the planning focus on both protecting the business and protecting the owners and their families.

Contributor

Carma MCallie, J.D., CAP® is a Vice President of Advanced Sales at Crump. She oversees a team of analysts and insurance design specialists who specialize in cases involving complex estate, business, and charitable planning strategies. Carma and her team work directly with financial professionals to provide case analysis and technical illustrations for cases involving planning with life insurance. Carma has been with the company since 2008 and has over 25 years of experience in the estate and business planning arena.