Businesses have faced unprecedented challenges in the past several years. From the global pandemic to supply chain disruptions and dealing with a bumpy economy to inflation, business owners have had to navigate a constantly changing world. The future will likely bring more uncertainties that can significantly challenge businesses. However, some challenges, like the unexpected departure of a business owner due to an injury, illness, or death can be anticipated and planned for in advance.

With other pressing issues, it can be easy to push succession planning down on the list. But this is one you shouldn’t overlook. A proper buy-sell plan can help minimize the financial and emotional stress on a business in the event of an unexpected owner's exit.

If you own a closely-held business, it’s probably not just your principal source of income but also your family’s most significant asset. However, if a premature death or disability occurs without a plan, the value of your business to you and your family could diminish overnight. Your family may feel forced into a partnership they didn’t choose, something they can’t handle, or worse, a situation nobody wants. Even if you are related to the other owners, a properly structured buy-sell agreement can be one of the most critical steps to controlling your business’s and your family’s future destiny.

The Five Events Triggering a Business Transition

Often referred to as “the five Ds”, death, disability, departure (usually due to retirement), disagreement, and divorce are critical events to consider. However, it’s important to focus on death and disability because these risks can be mitigated or transferred by purchasing

permanent or term life insurance products.

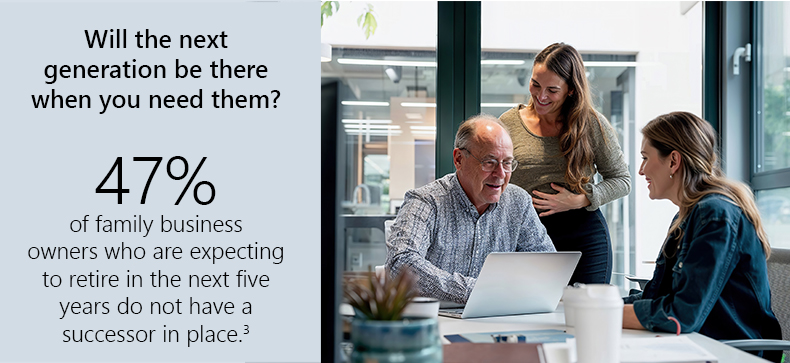

Keeping It In The Family

Owners of family businesses with intentions to pass the business to the next generation face unique challenges, with a relatively low percentage successfully transitioning as planned. The succession process to family is complicated by various factors, including generational differences, lack of interest among younger family members, and inadequate planning. Recent trends show only 19% of family businesses are going to the next generation, a decline attributed to younger generations preferring to start their own ventures rather than taking over traditional family businesses. If there is interest within the family, research indicates that about 30% of family businesses survive the transition from the first to the second generation, while only 12% make it to the third generation. The percentage drops even further to just 3% for those reaching the fourth generation and beyond.³

What is a Buy-Sell Agreement?

Fundamentally, a buy-sell agreement is a legally binding document that establishes a purchase price (or formula) for each owner’s share of the business and can guarantee a buyer and payment terms. When properly funded, it can provide liquidity at the exact time it is needed to complete the transaction on a tax-efficient basis. While a business valuation might serve as a useful initial phase in planning, owners alternatively may decide to only establish an agreed-upon value.

There are four types of buy-sell agreements, with entity-purchase and cross-purchase being the main types.

Entity-purchase | The business agrees to buy out the share of any deceased owner. It purchases, owns, and is the beneficiary of life insurance and/or disability policies on the lives of each owner.

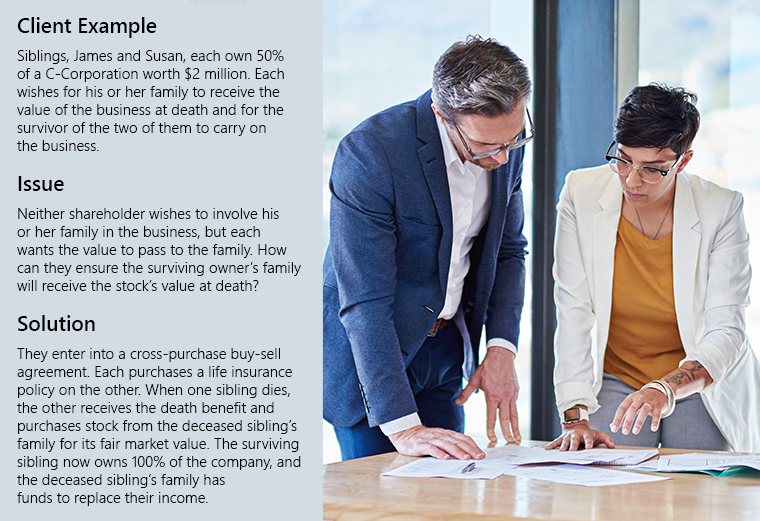

Cross-purchase | Each owner agrees to buy out the share of any deceased owner. They each purchase, own, and are the beneficiaries of life insurance and/or disability policies on the lives of each owner. This type of agreement is most common when businesses only have two or three owners.

"Wait and see purchase" | A third type of agreement, a hybrid, combines the flexibility of entity-purchase and cross-purchase and is called a “wait and see” purchase. At the death of an owner, the business has the first option to purchase, and if not exercised, the remaining owner(s) have the option to purchase. If the owner(s) decline or don’t purchase all the deceased’s interest, the business is obligated to buy the remaining interest. This agreement can be advantageous because ultimate ownership may be decided in the future after gaining more insight into how the company should be structured and potential changes in tax laws.

"One-way" purchase | This is a fourth type of agreement for single-owner businesses where a potential buyer(s) is identified, often family members or key employees. The business can pay the purchaser(s) a bonus to purchase an insurance policy on the owner’s life. As the beneficiary of the policy, the purchaser uses the death or disability benefit or the policy’s cash value to fund a buyout during the owner’s lifetime.

Do You Already Have An Exit Plan For Your Business?

Now May Be The Time To Review Your Buy-Sell Agreement Recently, there were two competing rulings in two different U.S. District Courts that may have an impact on certain types of buy-sell agreements from an estate tax perspective.

As of June 2024, one verdict has been appealed to and ruled upon by the U.S. Supreme Court. Because of this recent ruling and future potential legal outcomes, it is wise to seek attorneys and insurance professionals who are experts in their respective fields and, equally important, have any existing buy-sell agreements periodically reviewed.

Funding Buy-Sell Agreements

To better understand the value of using insurance products in buy-sell agreements, it helps to understand the considerations of other funding options (or combinations):

Liquidation of Business | It is likely not the choice anyone will want and poses a risk of not realizing the actual value of the business.

Bank Loan | It depends on a lender’s willingness to loan large sums to a business or surviving owner when a principal owner dies.

Installment Sale | The timing of the sale is unknown, and there is a potential that the future cash flow is insufficient.

Sinking Fund | Systematically setting aside money over time and hoping it accumulates creates an investment risk of the future return and tax rate.

Cash | When needed, it is possible that the reserves aren’t available or at the necessary level.

Life and disability insurance products offer an efficient way of protecting the value of your ownership and provide tax-free dollars at the exact moment they are needed to fulfill the buy-sell agreement. There are many different types of life and disability insurance products with differing costs, features, and benefits. While term life insurance is sometimes selected because of its low initial cost, there can be better options. Due to current tax laws, permanent cash-accumulating life insurance can be a very valuable planning tool, especially if an owner doesn’t die. Because cash value accumulates tax deferred inside a life insurance policy, it can be structured (today or in the future) as a personal asset with the potential ability to provide tax-advantaged income distributions.

Bottom Line

As a business owner, using a buy-sell agreement and planning for unexpected events like injury, illness, or death gives you confidence that your family can receive fair market value for your ownership interest once you voluntarily (or involuntarily) stop participating in the business. With a properly structured and funded buy-sell agreement, you can:

- Prevent disagreements between your family and co-owners

- Avoid potential liquidation to pay creditors and/or taxes

- Ensure your business won’t be owned by individuals who lack experience or the desire to manage operations

- Strengthen employee morale

- Improve standing with creditors, customers, and vendors Periodic updating of your business’s

valuation, agreement, and insurance policies can provide security and confidence for all owners and their families. For more information or to discuss using life insurance as a financial tool for buy-sell planning, contact your financial professional today.