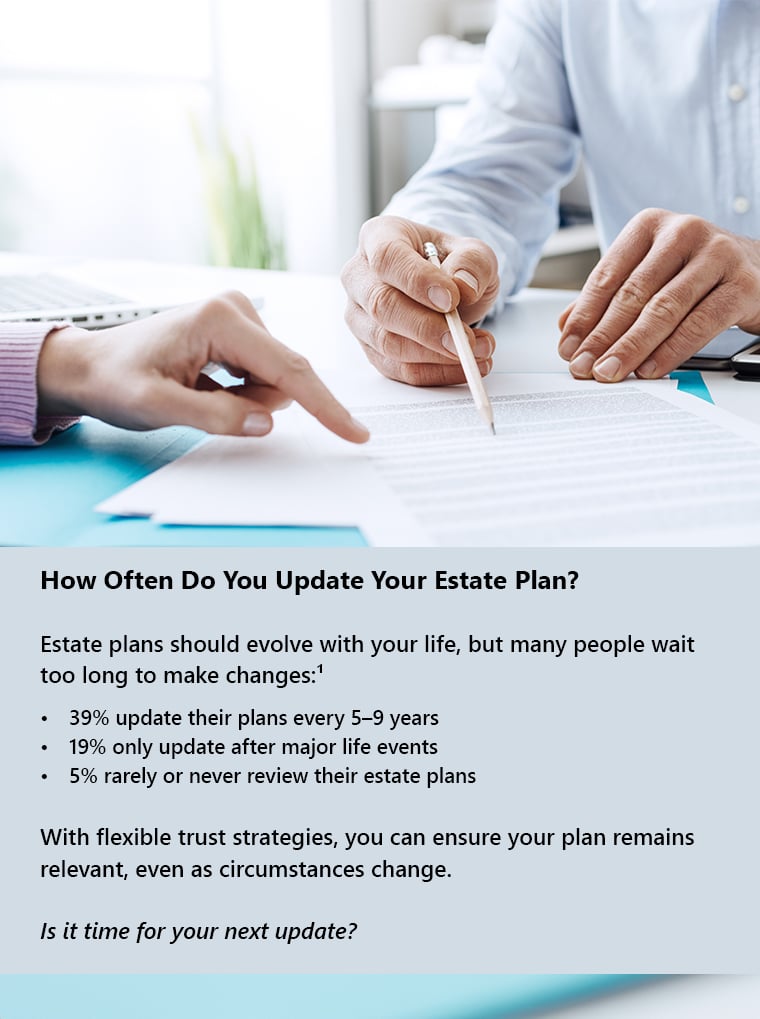

Change is an inevitable part of life, and adapting to these shifts helps reduce uncertainty and keeps us on course. While some changes are hard to predict, building flexibility into our plans can provide reassurance and security. When it comes to estate and tax planning, many options can feel rigid, creating hesitation to make decisions that seem permanent. Without a clear understanding of how estate plans can change with evolving circumstances, procrastination often sets in, delaying the essential steps needed to ensure a smooth and efficient transfer of assets to loved ones.

One of the most versatile tools in estate planning is the trust. Trusts serve various purposes, from managing assets for minors and avoiding probate to providing income, covering estate taxes, or creating a lasting legacy for beneficiaries. While revocable trusts are easily modified, irrevocable trusts — often used to remove assets from taxable estates — are perceived as inflexible, raising important concerns such as, “What if I need access to those assets later?” or “What if tax laws change?” Over time, skilled attorneys and tax advisors have developed innovative strategies to make irrevocable trusts more adaptable. Below are some effective solutions to add flexibility to a trust to address these concerns.

Key Strategies for Flexibility in Irrevocable Trusts

Irrevocable trusts are often used to remove assets from the taxable estate. However, to accomplish that goal, the original settlor must be restricted from controlling and accessing those assets. That generally includes strictly limiting the settlor’s ability to change the trust or directly benefit from it. With thoughtful drafting, irrevocable trusts can achieve estate planning objectives and provide adaptability.

Spousal Lifetime Access Trusts (SLATs)

One common way to gain access to trust held assets is by naming a spouse as a beneficiary while both spouses are still living. Once the settlor spouse sets up and funds the trust, the trustee is given the power to distribute assets to the beneficiary spouse if needed. This structure provides indirect access to trust assets, preserving flexibility within the marital unit. SLATs can hold various assets and are customizable to meet specific planning goals.

Considerations

- Address potential divorce or the death of the beneficiary spouse in the trust document.

- Consult legal counsel, as state laws significantly influence the pros and cons of SLAT designs.

Grantor Trusts

Irrevocable trusts can be set up so that the settlor is still considered the owner of the trust assets for income tax purposes, but the assets are removed from the estate for estate tax purposes. These trusts are frequently referred to as grantor trusts. While a full discussion of grantor trusts is beyond the scope of this article, the important point is that grantor trusts can include many provisions that provide flexibility for the settlor. Grantor trusts offer estate tax advantages while retaining certain income tax benefits for the settlor. They may include provisions that allow the settlor to:

Borrow assets from the trust.

- Swap assets inside the trust with those outside.

- Purchase illiquid assets from the trust using liquid funds.

- Loan liquid assets to the trust, maintaining liquidity for personal use if needed.

These provisions enable collaboration between settlors and trustees, balancing estate tax benefits with the settlor’s potential future needs. Careful trustee selection is essential, as the trustee’s ability to manage assets and distributions in alignment with the powers vested in the settlor directly impacts the long term success of the trust.

Trust Protectors

Trust protectors are relatively new to trust planning and can add a layer of adaptability to trusts, where there may have been challenges before. Depending on state laws, trust protectors can:

- Amend trust terms.

- Reallocate assets to charity.

- Modify beneficiaries.

- Terminate a trust when it no longer serves its purpose.

Including a trust protector ensures the trust remains relevant and responsive to changes in tax laws or personal circumstances by adding flexibility to meet the challenges of the future.

Many different types of trusts exist, each serving unique purposes, from securing assets and providing liquidity to ensuring financial stability for your loved ones. The best trust solution depends on your unique goals and should be selected with guidance from qualified counsel. Don’t forget that most trusts can own multiple asset types, including life insurance, to address diverse needs. Whether it’s leveraging trust assets or reducing financial challenges, integrating life insurance into your estate plan can add flexibility and strength.

Bottom Line

Trusts are indispensable tools in estate planning, offering various benefits beyond simply transferring wealth. From avoiding probate and maintaining privacy to protecting assets for minors or special needs dependents, trusts provide a secure and tailored framework for your legacy. They can help reduce estate taxes, shield assets from creditors, and establish specific rules for how and when beneficiaries receive their inheritance. However, every trust must be carefully tailored to individual goals, with input from knowledgeable attorneys and accountants to navigate the complexities of state and federal laws. Additionally, selecting the right professionals — who understand the importance of flexibility — is crucial to unlocking trusts’ full potential, ensuring tax efficiency, and adaptability to life’s inevitable changes.

Contact your financial professional today to discuss the role life insurance can play in your estate planning.

Trusts should be drafted by an attorney familiar with such matters in order to take into account income and estate tax laws. Failure to do so could result in adverse treatment of trust proceeds.

For Educational Use Only. Not intended for use in solicitation of sales to the public. Crump operates under the license of Crump Life Insurance Services, LLC, AR License #100103477. Variable insurance material is for broker-dealer or registered representative use only. Variable products may be distributed by P.J. Robb Variable, LLC, AR License #100110185. Member FINRA.

Crump does not provide any tax or legal advice.