As a financial professional offering life insurance and annuities, you understand the power of matching your clients to products designed to meet their needs. Like the first time in a new coffee shop, your clients may be overwhelmed by a menu brimming with choices. This is your opportunity to step in as their insurance planning barista, educate them on what is available, and help them determine the best fit. As their barista, they rely on you to navigate the best interest regulations and to ensure the suitability of the products you recommend.

Although something as straightforward (or seemingly simple) as ordering a cup of coffee might not hold the same stakes as proper insurance planning, relying on a barista to explain options and tailor preferences is similar to how your clients depend on you. And if you are looking for somewhere to turn for guidance on how to document insurance and annuity recommendations to ensure your clients have the products suitable to meet their financial needs—let Crump help you review “the menu” so you are ready to provide simplified, transparent recommendations to your clients.

Looking Over the Menu

Financial professionals must guide clients through available options, ensuring each recommendation aligns with the clients' best interest. To better illustrate this, let’s compare ordering a coffee in an unfamiliar place to selecting a life insurance or annuity product suitable for clients' financial needs. Awareness of the common areas of confusion or hesitancy will help you take the proper steps with your clients when recommending life insurance or annuity products and ensure you meet regulations.

-

-

- Understanding Preferences (Suitability Requirements)

As a barista asks about a customer’s taste preferences, financial professionals must assess a client’s financial goals, risk tolerance, and other relevant factors to recommend suitable products. - Explaining Options (Simplifying Jargon)

Coffee menus can be confusing, with unfamiliar terms and options. Similarly, insurance products often come with complex terminology. Financial professionals must break down these terms and explain them so clients can easily understand them. - Choosing Add-Ons (Product Options and Riders)

In a coffee shop, customers might add flavors, extra shots, or different types of milk. In the financial world, these are akin to selecting riders or additional features for an insurance policy—choices that can enhance or complicate a clients' plan to match their needs. - Disclosing Costs (Source of Funds and Disclosures)

Just as a customer needs to know the cost of their coffee, clients must understand the financial implications of their insurance purchase and consider the source of funds and any fees or charges associated with the product.

- Understanding Preferences (Suitability Requirements)

-

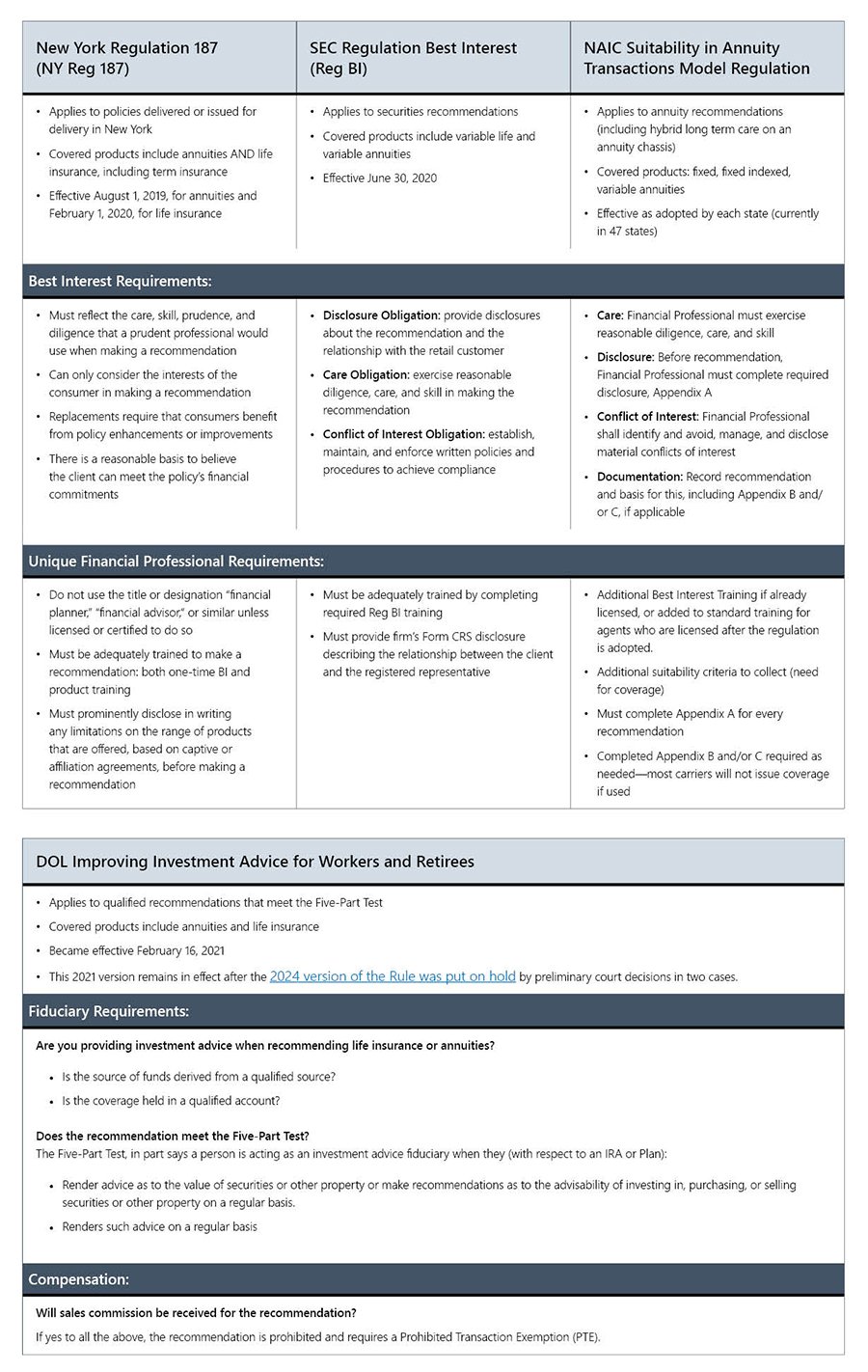

The Types of Best Interest Regulations

Staying compliant with multiple best interest regulations covering similar topics—but including different requirements and obligations—requires financial professionals to understand many details that sometimes can be overwhelming and cause frustration. This compliance confusion can result in the need to return to clients for additional requirements and processing delays. Whether you’re selling to a New York resident and need to comply with NY Regulation 187, selling an annuity in an NAIC-regulated state, or making a qualified annuity recommendation, breaking down the requirements of each best interest regulation will help you manage through these various requirements meant to protect both you and your clients.

Let’s break down the key regulations in the best interest environment, helping you better guide your clients through their financial decision-making process.

Bottom Line

Like a fancy cup of coffee, life insurance and annuity recommendations can be obscured by jargon and multiple choices—leading to consumer confusion, reluctance to ask questions, and dissatisfaction with purchases. Acting in the best interest of your clients and being the financial professional to provide clear, concise guidance—just as a skilled barista would—can ensure your clients leave the financial planning process feeling confident and satisfied with their choices.

In today’s regulatory environment, financial professionals often face the challenge of balancing multiple, overlapping regulations. The key to success lies in breaking down these requirements into manageable steps to help clients make informed decisions that align with their financial goals and objectives. Crump is here to guide you on making and documenting insurance and annuity recommendations to protect your business. We are here to answer questions and explain details to understand today’s best interest regulatory environment and how you can use your knowledge—with support from Crump—to provide simplified, transparent recommendations to clients.