It’s just as important to see a medical care provider for mental health concerns as it is to manage a physical condition like heart disease or diabetes.

Reframing society’s viewpoint on mental health has been a challenge for mental health professionals and advocacy organizations for many years. Due to deep-rooted stigma, people can be hesitant to honestly discuss symptoms with their physicians because they worry about receiving a mental health diagnosis. Often, distaste for a diagnosis is fueled by fear that people will view them differently.

Unfortunately, that worry keeps many otherwise healthy individuals from seeking the care they need to treat their mental health. This tendency to avoid open dialogue about mental health makes it challenging for financial professionals working with clients seeking insurance coverage. Insurance involving medical underwriting (life, disability, and long term care) requires a financial professional to gather a basic and honest medical history. Doing so allows them to guide the client to insurance options with reasonable expectations for obtaining coverage and cost. Some clients are very forthcoming; others wait until the insurance company discovers these diagnoses and histories during underwriting. Given that this is a sensitive subject to discuss, both scenarios can be challenging for a financial professional to navigate; however, Crump is here to help you work through each situation you encounter.

What to Ask In the Field

If your client shares that they have a mental health diagnosis, you should be prepared to gather the critical information below. This information will be needed for your Crump sales representative and underwriter to help set appropriate expectations for you and your client and suggest how to proceed in the insurance application process.

- Age

- Diagnosis

- Date of diagnosis

- Current medications taken, dosages, and recent dosage adjustments

- Previous medications taken (along with dosage) in the last 1-2 years for this diagnosis

- Current symptoms and how well they have been controlled over the last 1-2 years

- Frequency in which the client sees a doctor regarding this diagnosis and if they attend therapy

- Whether or not their mental health diagnosis caused any adverse related history such as loss of time at work due to symptoms, suicidal thoughts/attempts, any disability due to this, hospitalization, alcohol or drug misuse

- Note any additional health diagnoses or medications currently taken

Paint the Picture

When it is time to apply, don’t rely solely on the medical records to tell the underwriters about your client’s medical history. With the information your client shared about their mental health diagnosis, you can present your client in a cover letter accompanying the application. It helps to include details that may otherwise not be included in a doctor’s records or need further explanation. Not only will that letter be provided to the carrier, it will also allow the Crump underwriter to get to know your client’s story and help paint the most optimal picture of your client to carrier underwriters. This extra effort to humanize the client’s medical records or add non-medical details is conducive to obtaining the best underwriting outcomes for your clients.

What To Consider In a Cover Letter:

Situational Mental Health Illness | Frequently, mental health diagnoses stem from events in the client’s life, such as occupational stress, abuse, military/wartime-related services, divorce, grief, personal or family illnesses, job loss, and many others. These situations all prove challenging within the moment and trigger symptoms that should improve or resolve over time with appropriate treatment and care. If well explained in a medical history summary, these types of mental health symptoms/diagnoses tend to have more favorable insurance underwriting outcomes.

Controlled Symptoms | Insurance underwriters want to know if the client complies with prescribed medications and therapy/medical follow-up recommendations. Consideration is made for those who show they are actively taking steps to stabilize or improve their situation beyond what their doctor prescribed. This type of information is sometimes only apparent in medical records and it is up to the client, financial professional, and Crump underwriter to present that information to the insurance carrier.

Lifestyle | Hearing more about a client’s day-to-day life, social network, and family support system will shed light on how the client is coping with their mental health diagnosis.

Some clients’ diagnoses are going to be more advanced, precluding the best classes, but developing this overall profile is essential to obtaining the most favorable offer.

Here are some additional lifestyle questions to ask your clients that may encourage them to share more about their life with mental illness:

“How is work going?”

A positive outlook on one’s professional life is a good sign of stability in one’s overall routine.

“How is your family? Do you have the chance to spend time with them?"

Engagement in social interactions and a sound support system are essential in one’s mental health journey.

“Do you feel comfortable right in your current financial situation?”

Financial distress can be detrimental to mental health, as it is likely a foundation for many other things in one’s life. As a financial professional, you will most likely know about clients’ finances (as will the insurance underwriter), but encouraging your clients to share their perspective is equally important when gauging one’s mental health.

“Are you able to maintain an active lifestyle and focus on your health and nutrition?”

Clients who have a regular personal health regimen and take care of themselves to the best of their ability can be a positive indicator of controlled mental health symptoms.

Bottom Line

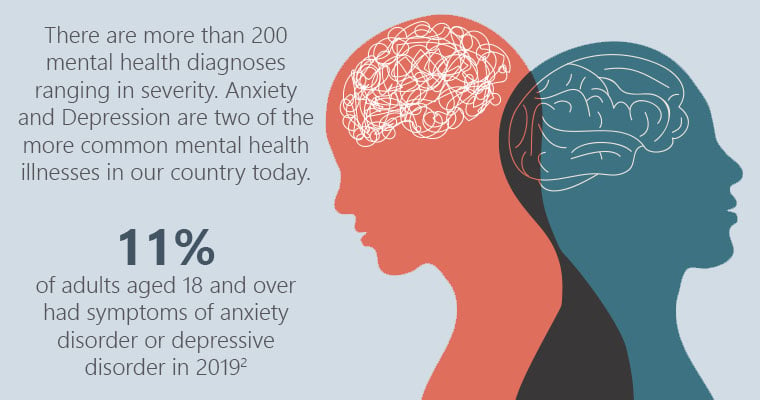

A significant portion of the population is living with some form of mental health diagnosis. And that doesn’t account for the people who have yet to share their symptoms or concerns with their doctor. Consequently, it is a widespread impairment seen in the insurance underwriting field, and it can be challenging to collect the whole story needed to underwrite the client accurately. That’s where financial professionals come in and have the opportunity to help their clients benefit from any advantage possible.

Although conversations surrounding mental health illness can be difficult or sensitive, it is ideal to gather the information discussed in this article when you first meet with your client or at the least when you complete the application. This eliminates the potential for conflicting information that can result in an unclear or unfavorable perspective. Creating a complete profile in a cover letter upfront will start the process positively and help set accurate expectations for your client.

Crump will do everything we can to advocate for you and your client. Our carrier underwriter relationships are unbeatable in the industry. Crump underwriters are excellent at creating a complete picture of a client’s application and work closely with you and the sales team. Our carriers rely on that intermediary information and support, and it is just one of many value adds you will find when working with your Crump team. Please get in touch with your Crump sales team and let us help you find the best solution for your clients.

Contributors

Emily Bancroft, MS, ALMI, AIRC, ACS, ALU Certified Professional Underwriter, is a Senior Underwriter with Crump Life Insurance Services. She has been with Crump for 19 years.

End Notes

1Centers for Disease Control (CDC)

https://www.cdc.gov/mental health/learn.htm

2Household Pulse Survey conducted by the National Center for Health Statistics and Census Bureau in 2020

https://www.cdc.gov/nchs/covid19/pulse/mental-health.htm