You understand the importance of estate planning to protect your financial legacy, yet it is tempting to avoid addressing this area of your financial plan. With the potential sunset of the current gift and estate tax laws, now is the time to move forward with an estate plan involving substantial lifetime gifts. This sunset means dramatic changes could take effect on January 1, 2026, and would cut current exemption amounts in half. Don’t wait until December 2025 to act. A limited window exists right now for high-net-worth individuals to move substantial assets out of their taxable estates without incurring a gift tax.

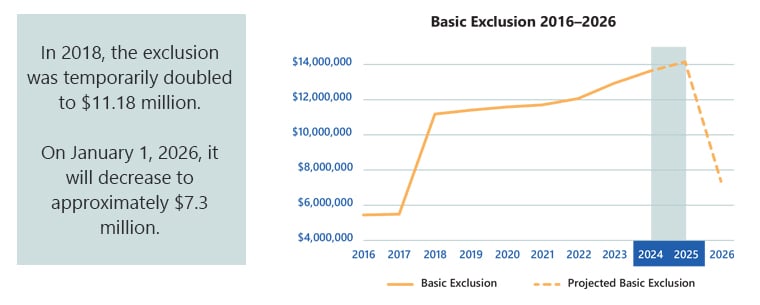

U.S. citizens and residents are subject to the gift and estate tax, which applies to transfers made during life or at death. Each individual is allowed a set amount to give away without incurring these transfer taxes, called the basic exclusion amount. This exclusion shields lifetime transfers from the gift tax. To the extent it is unused at death, any remaining exclusion reduces the estate tax. In 2018, the basic exclusion amount was significantly increased until January 1, 2026, when it will be cut in half.

Under current law, the 2024 unified exemption amount is $13.61 million per person (or $27.22 million per married couple).1 The unified exemption amount is indexed for inflation. It will rise along with the cost of living in 2024 and 2025 before being cut in half in 2026. Assuming an annual inflation rate of 4% in those two years, in January 2026, individuals will be left with a basic exclusion amount of only $7.36 million.

Congress may change the law before the sunset in 2026, extending the current basic exclusion amount or even replacing it with an entirely new amount, tempting many to wait and see. However, waiting until December 2025 could leave taxpayers with too little time to complete the necessary processes and paperwork to make substantial tax-free gifts.

Reasons to Take Action Now

Finding a Qualified Attorney | A lot of planning and preparation goes into making a multi-million dollar lifetime gift. Often, gifts of this size are not made directly to a person’s descendants but into trusts for their benefit. These trusts can be complicated; therefore, an attorney specializing in trusts will need time to prepare the documents. As the sunset draws closer, these attorneys will be inundated with requests to set up these gifting trusts. Clients who wait until the last minute may struggle to find a competent attorney to help them in time.

Appraisals | In many situations it makes sense to give away assets, not cash. Assets not publicly traded on an exchange can be challenging to value and typically require a qualified appraisal to determine the amount transferred for gift tax purposes. An appraisal can take several weeks to complete at the best of times, but in 2025, when many people are scrambling to make last-minute gifts, the time frame could be several months. Waiting until the end of 2025 to start the process creates a substantial risk that the appraisal will not be ready until after the sunset.

Life Insurance Underwriting | Life insurance often plays a vital role in estate planning by using trust-owned policies for cash to pay the estate taxes due at the insured’s death. Underwriting for life insurance used on large estate planning policies can sometimes take months, depending on the insured’s health history. Waiting until the end of 2025 to start this process could also cause delays.

Client Showcase

- Raymond and Regina, ages 69 and 71, are married with a combined estate of $21 million that today is growing at 4% annually.

- They are considering using both of their exemptions now before the sunset to reduce their taxable estates by the maximum amount possible under current law.

- Making these gifts today might save them approximately $4,778,812 in future estate taxes.

Bottom Line

The time to act is now. Your financial professional can help you create plans to take advantage of the temporarily generous gift tax laws. By taking action sooner rather than later, you will have time to vet and hire a competent attorney, who will, in turn, have time to draft a robust trust or any other needed estate planning documents. Appraisal companies will have the capacity to provide any necessary valuations to move assets such as real estate and closely-held business interests out of the taxable estate. Any life insurance strategies can be appropriately underwritten and designed.

It’s also important to remember that Congress constantly changes estate and gift tax laws. Don’t put your faith in Congress to enact permanent laws in a timely manner and miss this opportunity. If you prefer to wait until the law is settled, you could be waiting forever. The best course of action is to plan under the current laws and regularly review and update your plan based on changes to the laws and your own personal and financial circumstances. Estate planning is not an event; it is a process. This window to move more than $13 million out of your taxable estate is not guaranteed to occur again.

At Crump, we pride ourselves on our holistic approach to insurance planning, tailoring solutions to fit every stage of life. As a top player in the industry, we provide a diverse array of insurance products and boast a powerhouse team of seasoned professionals and attorneys well-versed in crafting sophisticated insurance solutions around wealth transfer, retirement, and business needs. We care deeply about supporting families and businesses in managing risks and navigating life’s uncertainties. Reach out to your financial professional to schedule a consultation with Crump to get started in your journey to safeguarding what matters most.

Contributors

Jon Whitacre, JD, CLU, ChFC is a Senior Director of Advanced Sales with Crump Life Insurance Services. He is a recognized speaker and author with over 20 years of experience working with clients and financial professionals on complex insurance planning strategies. Jon specializes in tax analysis and research.

Karl Heideman, CLU, FLMI is a Director of Advanced Sales at Crump Life Insurance Services. He offers case consultation and design support to financial professionals. Karl is experienced in estate planning, business succession planning, and executive compensation.

End Notes

1Revenue Procedure 2023-34

https://www.irs.gov/pub/irs-drop/rp-23-34.pdf

Case studies are used to show how insurance solutions can be useful in the marketplace. Examples shown do not guarantee similar results as individual results may vary. When case studies are based on real life situations, the personal and financial information is changed for privacy reasons.

Trusts should be drafted by an attorney familiar with such matters in order to take into account income and estate tax laws. Failure to do so could result in adverse treatment of trust proceeds.

For Educational Use Only. Not intended for use in solicitation of sales to the public. Crump operates under the license of Crump Life Insurance Services, LLC, AR License #100103477. Variable insurance material is for broker-dealer or registered representative use only. Variable products may be distributed by P.J. Robb Variable, LLC, AR License #100110185. Member FINRA.