As a financial professional serving many clients in different situations, you may have encountered a female client who was reluctant to make a suggested investment. Unfortunately, this profile permeates the industry and has falsely labeled women as risk-averse. A woman who hesitates to act on an investment is not necessarily averse to the risk but may be more aware of her personal stakes and factors to consider.

Women tend to spend more time researching their choices and finding a suitable investment to meet their risk tolerance. It doesn’t mean there isn’t an interest and a need, especially with women generally having less retirement savings. However, after years of less earning power or fewer years in the workforce, many women have less disposable income to invest in their future. With a genuine concern for growing their wealth, women are typically open to planning guidance. It is essential to understand the factors influencing women’s planning behaviors and anticipating their needs. Doing these two things can help financial professionals differentiate themselves within this demographic.

It can be easy to use the same methodology and planning with a female client as a male client, especially with more women today making significant contributions to household income. Research done by Allianz found that 43% of women said they were the primary breadwinners in the family, up from 34% in 2022.² However, this position doesn’t necessarily mean women have the same liquidity, savings, and financial planning behaviors as their male counterparts.

Knowing exactly what women are looking for in financial planning and how to provide unique guidance is essential. Nationwide’s Advisor Authority survey showed that almost 100% of financial professionals who took part felt well-equipped to take on more women clients. 90% said they intended to do so in the next year, which is more than a 10% increase from August 2023. However, in the same survey, it was found that only around half of the female participants currently working with a financial professional said they felt their financial goals were understood.³ Taking a beat, paying attention to your female clients’ concerns, and being cognizant of the factors they may face will build their trust and confidence to pursue planning solutions to find security in retirement.

Factors Facing Women Planning for Retirement

Women face unique socioeconomic challenges that necessitate a more conservative approach to retirement planning, as women may have less disposable income and more caregiving responsibilities, ultimately impacting their ability to save consistently over time.

Wage Disparities | The gender pay gap remains a genuine factor for women and has made little movement since 2002. Constantly behind their male counterparts, women can’t catch up. On average, women working full-time, year-round, earn $0.84 for every dollar earned by men, with even lower earnings for women of color.⁵ If a woman is unable to work full-time and takes on part-time or seasonal employment, which is roughly a third of the U.S. workforce, that amount drops to $.78. That equals a loss of $11,450 of earnings over a year, based on the median annual pay.⁶

Women of color or minority races, such as Black, Hispanic, Native Hawaiian, and Pacific Islander, and some subsets of Asian women, face even more significant disparities in addition to job segregation into lower-paying jobs.⁶

Career Interruptions | Caregiving responsibilities tend to fall to the female of the household, resulting in a later start in their career or gaps in employment while caring for young children, children with special needs, and aging parents. This creates potential hardships during earning years and dramatically hinders a woman’s ability to invest for retirement.

The gender pay gap may not be an issue in the early years of one’s career, but according to the Pew Research Center, a pattern that has not changed in nearly four decades is the widening of the gender pay gap starting when men and women are ages 35 to 44. These can be peak years for career advancement and promotions, allowing men’s salaries to increase; however, this is also when women often step in and out of the workforce to take care of family. This gap in their career can be costly for women’s long-term savings goals. In 2022, women ages 25 to 34 earned about 92% as much as men in the same age range, but women ages 35 to 54 earned 83% as much. That percentage drops to 79% for women ages 55 to 64, leaving little to no time to catch up.⁸

In addition to wage discrimination and potential loss of higher wages with career advancement, women who cannot work consecutively are more likely to make fewer 401(k) contributions and possibly receive lower social security benefits.

Inflation and Rising Costs | Like their male counterparts, women face inflation and the increasing cost of living. According to the Nationwide Advisor Authority survey, 70% of women investors said they are rethinking the timing of their retirement or if they can retire at all.³ This growing concern is partly due to inflation and signs of a potential recession—an even more significant problem for single women. Survey results showed that among the most common topics that single women want financial professional guidance on, 34% of them said they are looking for solutions to accumulate enough savings to be able to retire and not outlive their retirement income.³

Longevity | In 2021, the Centers for Disease Control and Prevention (CDC) reported that women live almost six years longer than men.¹º With those extra years of retirement and a cumulative income disparity throughout their working years, women are on a path to have less money to save and more years to need income in retirement. Coming with longevity is the potential for more health issues and needed care. A study conducted by HealthView Services found that women aged 63 can anticipate spending 30% more on health care while in retirement.¹¹ This financial insecurity forces women to be cautious in making decisions and calculating how to leverage their money within their risk tolerance.

Bridging Retirement Savings With Annuities

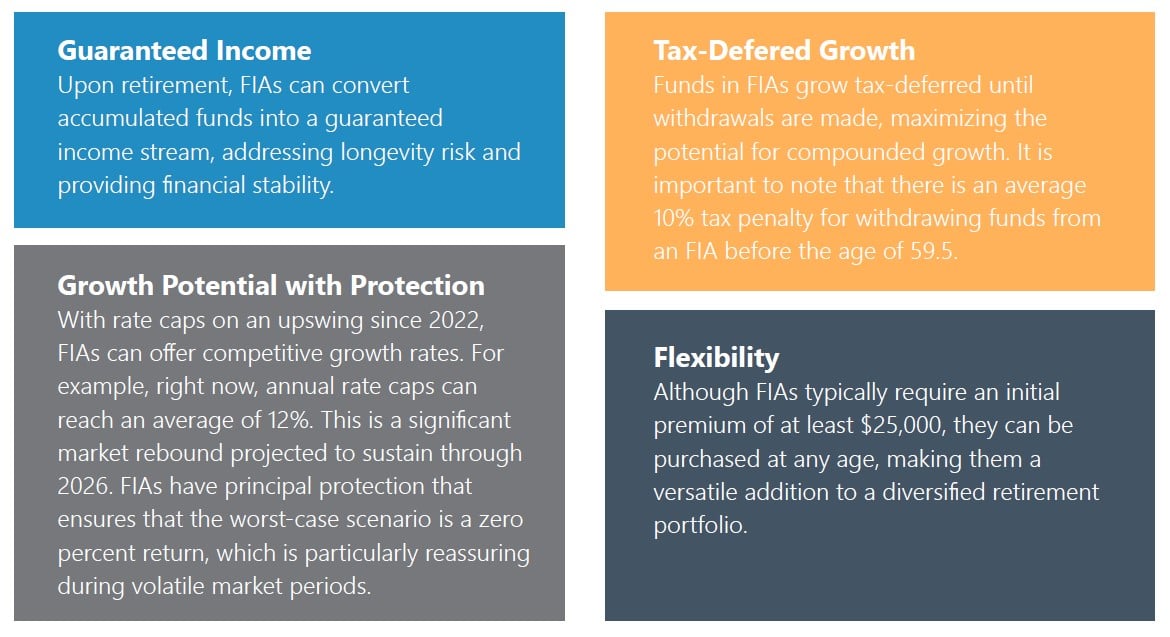

A Fixed-Indexed Annuity (FIA) can be a powerful tool to enhance financial security and bridge the retirement savings gap. Women can create a more robust retirement plan by utilizing an FIA in addition to their 401(k) savings. With a blend of growth potential and security, FIAs appeal to women looking to catch up for retirement.

FIAs are not intended to replace 401(k) plans but instead provide an additional tool to maximize earnings for retirement income. A common strategy involves maximizing an employer 401(k) matching program and allocating additional savings to FIAs. This approach leverages the full growth potential of the 401(k) while providing a safety net through the FIA, balancing market exposure with guaranteed income.

Bottom Line

By being prepared and aware of women’s challenges when building their long-term wealth, you can deploy a personalized approach with your female clients. They will value the tailored guidance that aligns with their circumstances and retirement goals. Women tend to seek long-term relationships with their financial professionals and are more loyal when they can trust that their goals are understood and respected. You can help women build confidence in their financial security by educating them on their options and empowering them to take control of their financial futures with a suitable plan for their risk tolerance.

Crump is here to help you and your clients incorporate FIAs into a comprehensive retirement strategy. Contact our Crump Annuity Solution Center today for more information on offering your female clients a balanced approach with annuities that mitigate risk while capitalizing on growth opportunities, ensuring a secure and prosperous future.

Contributor

Alissa Hufford is the Director of the Crump Annuity Solution Center. She has been with Crump for 25 years, and during her tenure, she has learned about all facets of the annuity industry by working in almost every area of the Crump Annuity Solution Center. Today, Alissa leads a team of about 20 annuity sales desk associates and internal wholesalers. Together, they are a valued resource to financial professionals and clients learning how to fit annuities into their overall financial plan. Alissa holds her Series 6 license.